Supreme Court Strikes Down Trump Tariffs - But He Has 'Backup Plan'

"IEEPA does not authorize the President to impose tariffs," wrote the court.

This article originally appeared on ZeroHedge and was republished with permission.

Guest post by Tyler Durden

The Supreme Court on Friday struck down Trump’s tariffs. In a 6-3 decision (170-pages), the court ruled that Trump’s use of the 1977 International Emergency Economic Powers Act (IEEPA) - which constitute about half of the tariffs we’ve seen under Trump - was not lawful. Kavanaugh, Thomas and Alito dissented.

“IEEPA does not authorize the President to impose tariffs,” wrote the court.

The ruling stems from a consolidated challenge brought by small businesses and multiple states, including Costco, who argued that the statute - originally intended to authorize sanctions and asset freezes during national emergencies - does not grant the executive branch the power to levy taxes on imports. The Court reasoned that the Constitution vests the authority to impose duties and tariffs with Congress alone, and found that IEEPA’s authorization to “regulate … importation” cannot be interpreted to include the distinct taxing power required to enact broad-based tariffs. The ruling affirms lower-court decisions blocking the challenged measures, concluding that the administration’s emergency-based tariff framework exceeded the limits of the statute.

Trump invoked IEEPA to impose his ‘reciprocal’ tariffs on nearly every foreign trade partner to address what he called a national emergency over US trade deficits. He invoked it again to impose tariffs on China, Canada and Mexico over fentanyl trafficking into the United States.

Friday’s decision rests on the notion that tariffs are not merely a tool for regulating trade, but also a a form of taxation that the Constitution reserves to Congress. Citing Article I, Section 8, the majority stressed that the power to impose tariffs is “very clear[ly] … a branch of the taxing power,” and that the Framers gave Congress “alone … access to the pockets of the people.” The administration had argued that IEEPA’s grant of authority to “regulate … importation” permitted the President to impose tariffs in response to declared national emergencies. The Court rejected that interpretation, noting that while “taxes may accomplish regulatory ends, it does not follow that the power to regulate includes the power to tax as a means of regulation.”

The majority also pointed to the statute’s text, emphasizing that IEEPA authorizes the President to “investigate, block … regulate, direct and compel, nullify, void, prevent or prohibit” certain transactions - yet makes no mention of tariffs or duties.

“Had Congress intended to convey the distinct and extraordinary power to impose tariffs,” the opinion states, “it would have done so expressly, as it consistently has in other tariff statutes.”

The Court further highlighted a lack of historical precedent - noting that that in the nearly 50 years since IEEPA’s enactment, “no President has invoked the statute to impose any tariffs,” and that combined with the sweeping economic impact of the measures at issue - it was a “telling indication” that the asserted authority falls outside the President’s legitimate reach.

Applying what it characterized as the “major questions” framework, the Court reasoned that Congress would not delegate such sweeping control over trade policy through vague language. The President’s claim that two words - “regulate” and “importation” - authorize tariffs “of unlimited amount and duration, on any product from any country,” the majority wrote, would represent a “transformative expansion” of executive authority over tariff policy and the broader economy.

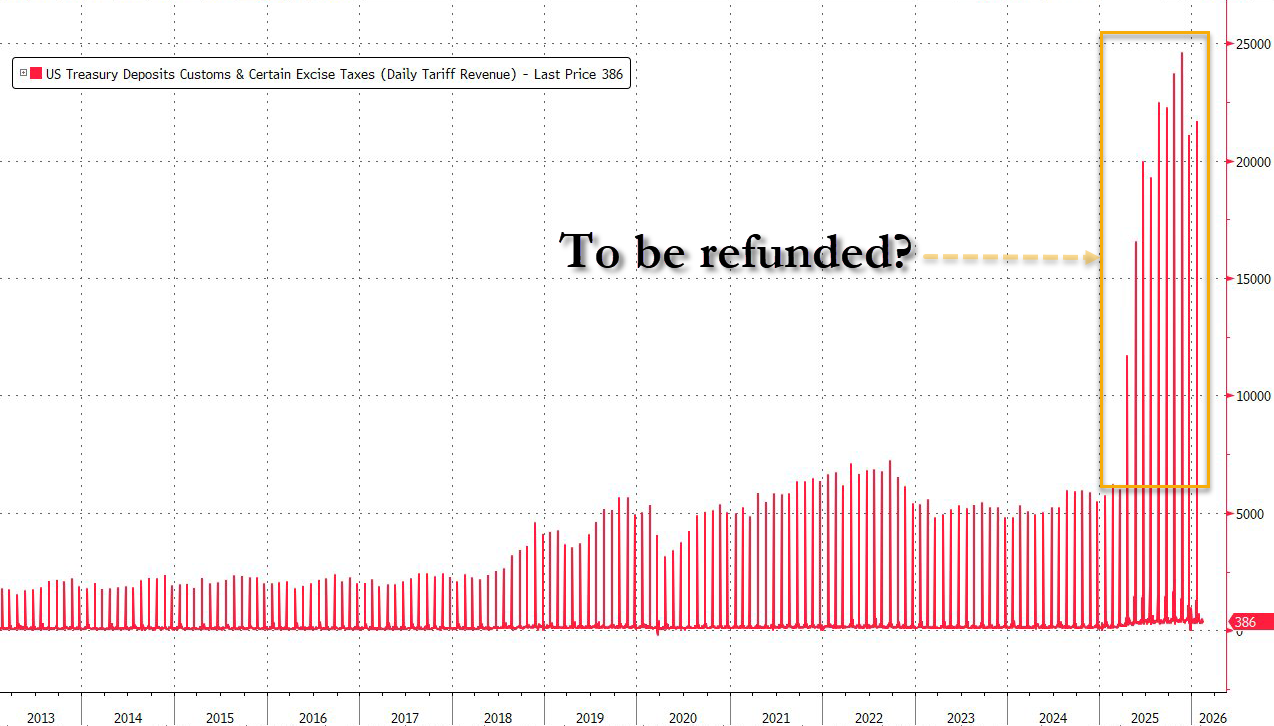

Tariff Refunds?

Notably, the Court’s ruling does not address what happens to the billions of dollars in tariff revenue already collected under the now-invalidated IEEPA framework, leaving open the possibility of a wave of refund litigation in the months ahead. There are currently hundreds of tariff refund lawsuits pending in US trade court.

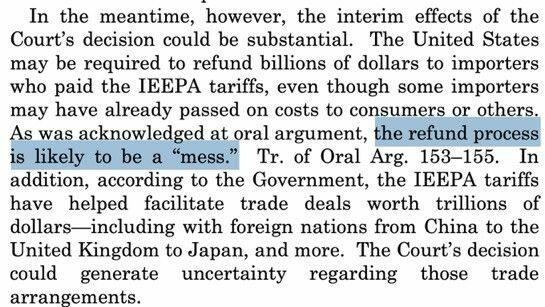

While the majority opinion strikes down Trump’s use of IEEPA, it offers no guidance on restitution, repayment, or whether importers may be entitled to recover duties paid pursuant to tariffs the Court has now deemed unlawful. That omission is likely to shift the next phase of the dispute into the U.S. Court of International Trade, where importers may seek retroactive relief through administrative protests or refund actions.

Justice Kavanaugh’s dissent notes that the process is likely to be a “mess,” warning that “the Court’s decision is likely to generate other serious practical consequences in the near term,” adding “One issue will be refunds.”

Trump’s administration has not provided tariffs collection data since December 14. But Penn-Wharton Budget Model economists estimated on Friday that the amount collected in Trump’s tariffs based on IEEPA stood at more than $175 billion. And that amount likely would need to be refunded with a Supreme Court ruling against the IEEPA-based tariffs. -Reuters

Any such claims could involve complex questions of sovereign immunity, administrative exhaustion, and the availability of equitable relief - particularly where duties were paid without timely protest. Whether courts ultimately require repayment of unlawfully imposed tariffs may depend not just on the validity of the underlying statute, but on the procedural posture of individual importers and the statutory refund mechanisms available under U.S. customs law.

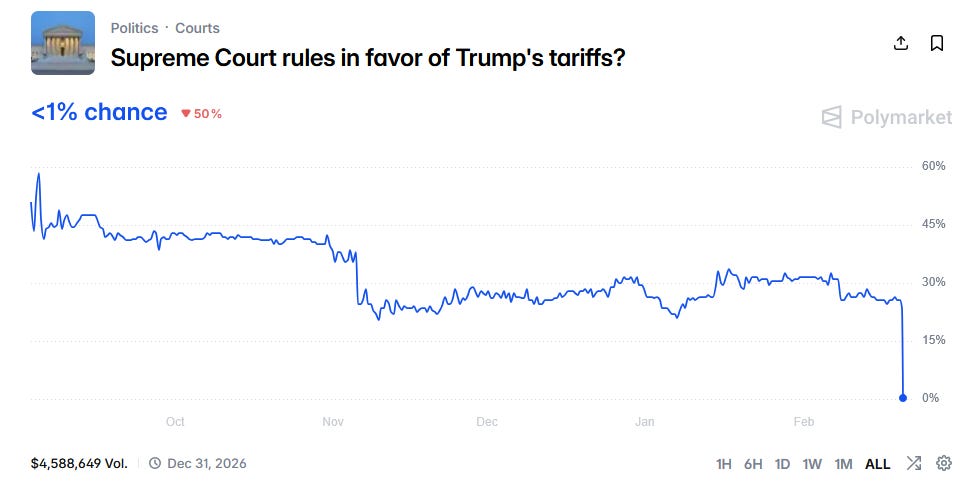

During arguments on Nov. 5, the court seemed skeptical over Trump’s authority to use IEEPA, leading most observers observers, including betting markets, to conclude a high probability they’re struck down at least in part. The Trump administration is appealing lower court rulings that he overstepped his authority, while Trump himself said a Supreme Court ruling against the tariffs would be a “terrible blow” to the United States.

Other Options

That said, even if that happens, the Trump administration has several other legal avenues they can pursue. As Deutsche Bank noted last month;

For instance, the sectoral tariffs (e.g. on steel and aluminum) aren’t covered by the court ruling, whilst another option would be to use Section 122 of the 1974 Trade Act, which permits temporary 15% tariffs for 150 days.

And Goldman:

This won’t be the end of tariffs… the administration will almost certainly roll out alternative legal frameworks. Net result is probably slightly fewer tariffs, materially more trade uncertainty, and some incremental deficit concerns. Net-net, that’s mildly supportive for equities and mildly negative for bonds… but largely priced for both.

Trump called the ruling a ‘disgrace,’ and told governors at a White House breakfast that he has a ‘backup plan’ in mind, though no details on that.

ZH Premium Members - stay tuned for an in-depth look at these options...

Meanwhile, prediction markets got this one right.

Copyright 2026 ZeroHedge