Las Vegas Slowdown Deepens as Gamblers Reject Unaffordable Sin City

When the high rollers stop rolling, the crash is already here.

This article originally appeared on ZeroHedge and was republished with permission.

Guest post by Tyler Durden

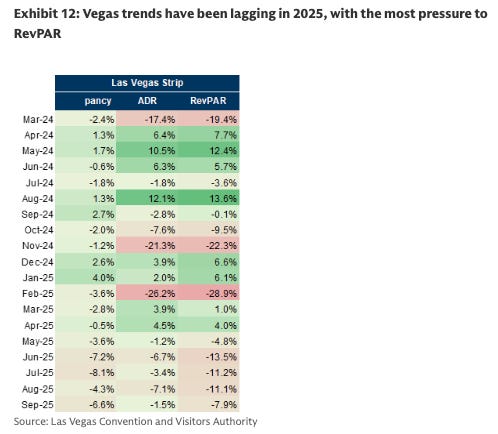

A Las Vegas downturn first emerged on our radar early this past summer and has only deepened into fall.

We previously noted that the days of cheap room rates and discounted buffets to lure gamblers are long gone, replaced by steep markups on even the smallest of items. For many working-class Americans, Vegas has become unaffordable, and the latest data from Goldman analysts show the Strip slowdown persisted through September.

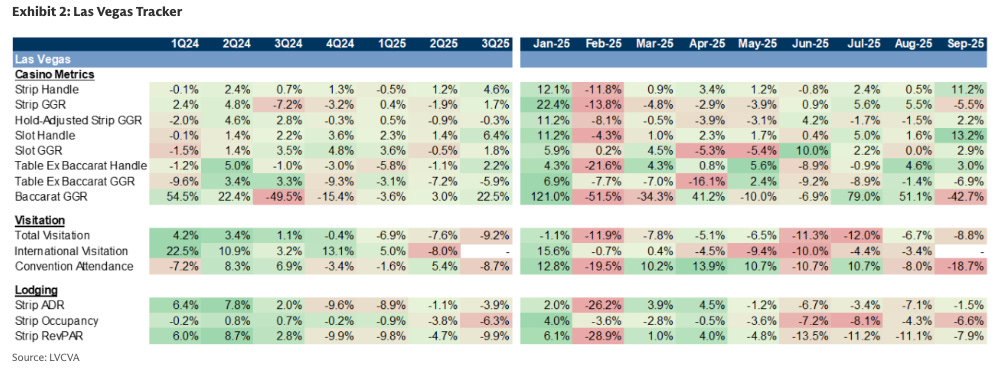

“Las Vegas trends remain lackluster,” Goldman analyst Lizzie Dove wrote in a note citing a series of data points, including visitation and gambling metrics, that marked the ninth consecutive quarter of year-over-year visitation declines and continued softness across the Strip in September.

#ad: Your diet isn’t perfect—and that’s okay.

Global Healing’s Organic Multivitamin is here to help you fill the gaps with over 30 essential vitamins and minerals your body needs to feel its best.

There are no coatings, no fillers—just clean, high-quality nutrients your body can actually use. It’s a simple, effective way to support your daily health and give your body the care it deserves.

Experience the difference you can actually feel. Use code VFOX at checkout for 10% off your order.

DISCLOSURE: This is an affiliate link. I may earn a commission if you make a purchase here, at no additional cost to you.

Here are the key Vegas trends to focus on:

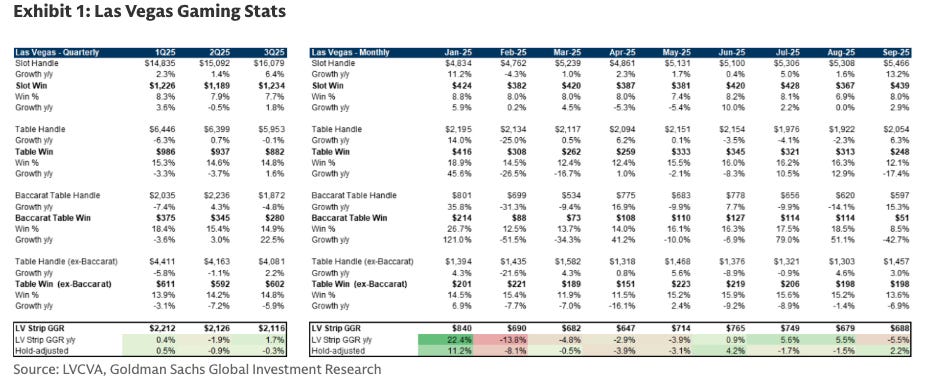

Visitation: Down -8.8% y/y in September, following -7% in August and -12% in July. Convention attendance was especially weak (-19% y/y) due to the calendar shift of Oracle CloudWorld to October. Overall visitation fell -10% y/y.

Hotel Metrics: Las Vegas Strip RevPAR fell -7.9% y/y, driven by ADR -1.5% and occupancy down 570 bps to 81.3%. Weakness was sharper mid-week.

Gaming Revenue (GGR): Strip GGR declined -5.5% y/y to $688mn, largely due to a very low baccarat hold (8.5%) versus the two-year average of 16.3%. Adjusting for hold, GGR would have actually grown +2.2% y/y.

Despite falling visitation, gambling trends increased 11% y/y, suggesting operators are attracting higher-spending, gaming-focused visitors over general leisure tourists

Las Vegas Gaming Stats

Las Vegas Tracker

Vegas trends have been lagging in 2025, with the most pressure to RevPAR

Vegas casino stocks have been sideways since the pandemic.

Related:

August: Las Vegas Tourism Falters As Prices Explode And Amenities Disappear

July: Another Canary: The Las Vegas Economy Is Tanking Just Like It Did In 2008 And 2009

Perhaps the Wall Street Journal report this week about the GOP’s midterm political convention potentially being held in Sin City next year could bring some tailwinds. However, casino operators still need to address the growing affordability issue in the city.

Copyright 2025 ZeroHedge

Everything is corporatized.

Once the corporation has attained monopoly/oligopoly power, the consumers are screwed.