NOTE: This is a sponsored interview with our trusted partner, BlockTrust IRA. We only team up with companies that share our principles and offer real value. By reading on, you’re helping us keep independent news alive. We receive compensation when you engage with our partners. Thank you for your support.

Just recently, President Trump signed a groundbreaking executive order that opens the $9 trillion 401(k) market to alternative assets—like cryptocurrency, gold, and private equity.

For the first time, everyday Americans may soon be able to diversify their retirement accounts beyond Wall Street’s limited options, which is shaking up the financial system and giving people more control over their future.

This latest move builds on Trump’s unwavering support for cryptocurrency. In March, he declared, “I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

So what does this latest news mean for crypto, for investors, and for the future of money in America?

To break it all down, Jonathan Rose from Block Trust IRA joins us now with exclusive insights on what he thinks comes next.

NOTE: The following transcript is a condensed version of the conversation. For the full discussion, watch our exclusive interview with Jonathan Rose.

QUESTION 1

MARIA: “President Trump just signed an executive order that opens up 401(k) plans to include crypto, gold, and private equity—something the Biden administration actively resisted. What do you make of this shift? And how much of a game-changer is this for the crypto market and everyday Americans trying to protect their retirement from inflation?”

JONATHAN: “I think it’s absolutely amazing. It’s almost like a $9 trillion earthquake that President Trump has just announced. Because you’re right, the former administration made it very hard for people to invest in other assets outside of their 401k.

“It’s been very restricted. It’s almost like you’ve got a choice of A, B, and C—and a lot of the time, those choices are investments people don’t even want. Maybe they don’t even align with their moral beliefs of how these companies operate.

“So now we’ve kind of got an earth-shattering deal under President Trump. And I think sooner rather than later, people will start having access to cryptocurrencies and more choices in their 401k. That’s going to help the general public get ahead. We’re seeing the biggest wealth transfer in history, and a lot of people are realizing they want to be a part of it.”

QUESTION 2

MARIA: “We’re also learning that Trump Media—the company behind Truth Social—has accumulated around $2 billion in Bitcoin and related assets. That’s roughly two-thirds of its $3 billion in liquid holdings. What does this tell you about President Trump’s confidence in crypto? And could this be a sign that mass adoption is getting closer than people realize?”

JONATHAN: “Yeah, I mean, it’s a big play. And it just goes to show the confidence that the current administration has in cryptocurrency. Now, on our platform, we have over 60 different cryptocurrencies.

“There’s a reason why President Trump has put Bitcoin into the U.S. Treasury as an asset. Just like gold’s there and other yield notes are there—it’s because it has a fixed supply. It’s kind of like the flagship of all the other different cryptocurrencies out there.”

If Trump’s hedging with Bitcoin, why can’t you? With BlockTrust IRA, you can make the same strategic moves without needing billions.

Protect your future like a leader, not a follower. Talk to a trusted crypto expert at DailyPulseCrypto.com and make your move today.

QUESTION 3

MARIA: “The U.S. national debt is now at a whopping $37 trillion. And it seems like it’s only on track to get higher.”

“Larry Fink of BlackRock and Coinbase’s Brian Armstrong have both suggested that if the debt continues spiraling out of control, Bitcoin could eventually challenge the dollar’s status as the world’s reserve currency.

“What’s your take on America’s debt crisis. And do you think Bitcoin could actually replace the U.S. dollar?”

JONATHAN: “Crazy. Because a statement like that, five years ago people would say you’re just crazy. You know, you’re a conspiracy theorist. But normally the people that have these conspiracy theories, they end up being right.

“I think they’re absolutely right. Because what they’re really talking about is de-dollarization. And de-dollarization is mainly due to $37 trillion in debt… We’ve got a locomotive of runaway debt happening right now. It’s not slowing down.

“So what that basically means is de-dollarization is an impact of people losing faith in the U.S. dollar. They’re moving away… and they’re talking about people finding alternative assets to trade in.”

QUESTION 4

MARIA: “Many crypto investors like to buy and hold. If you buy Bitcoin at $100,000, and it goes up to $120,000, you made $20,000. It’s simple.

“But your Animus AI platform takes a much more active approach. Can you explain how it works? And could people be leaving money on the table when they stick to old-school strategies?”

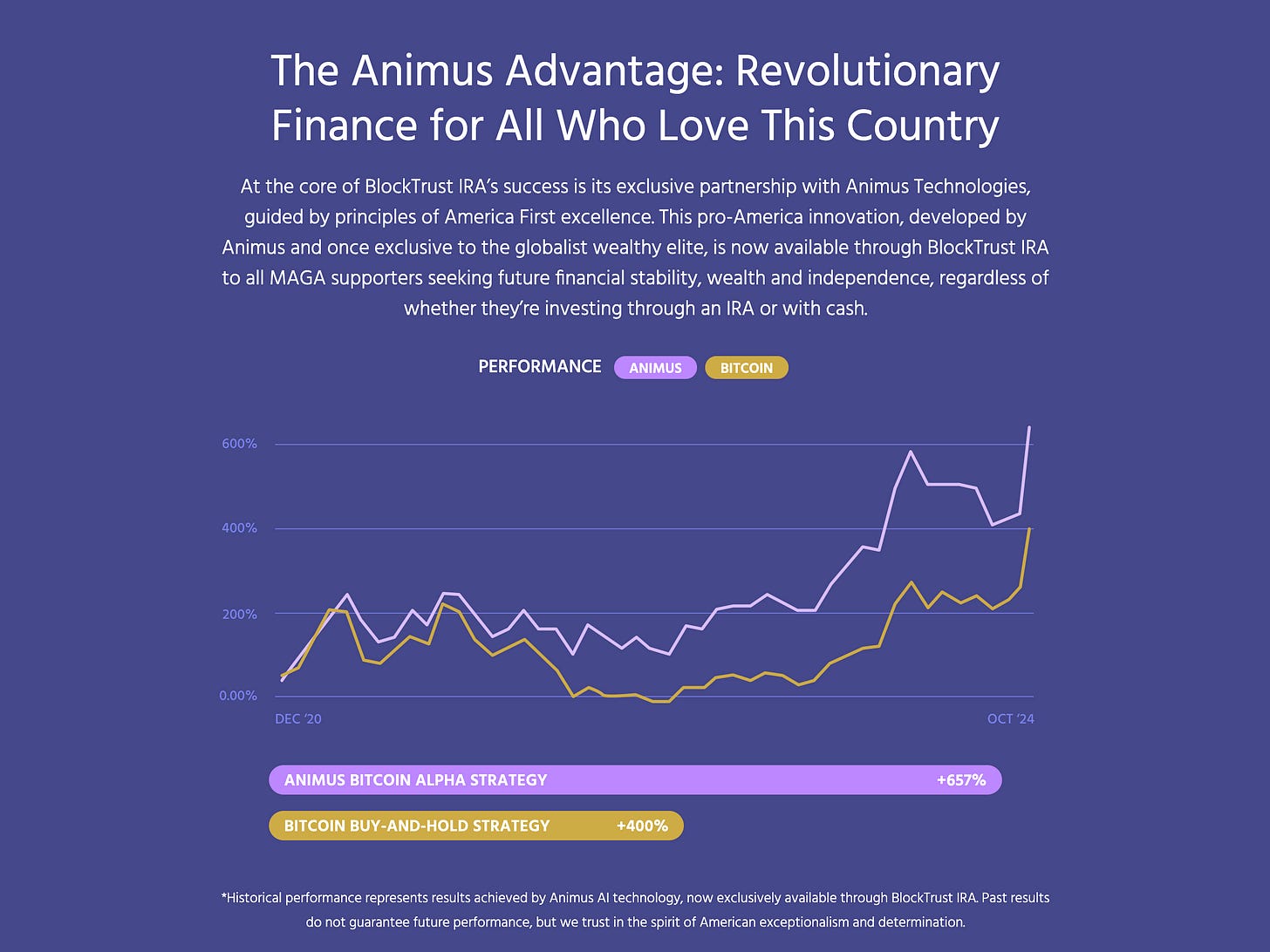

JONATHAN: “Buy and hold strategies are great for an asset like gold. You can buy it, throw it in the safe, and forget about it.”

“But when you look at the crypto market, it’s trading 24/7, 365. There’s no opening bell, there’s no closing bell. So it’s going, going, going—even when you sleep.

“Our AI gives us signals and lets us know when there’s volatility in the market. When that happens, we move our clients into a cash position—like a lifeguard waving the red flag. And when it’s safe, we re-enter.

“That does two things: one, it mitigates drawdowns; two, we buy back in at lower prices and accumulate more coins. That’s called compounding—and that’s my favorite word in investing.”

QUESTION 5

MARIA: “Some of our viewers worry they’ve already missed the boat on crypto. They fear buying at all-time highs and becoming a bag holder. What do you say to them?”

JONATHAN: “Absolutely not. Right now we’re at 11% adoption rate for Bitcoin globally—which is nothing. Just to put it in comparison, that’s almost like where the internet was first discovered.

“So we are still at the forefront—early, early stages—of the cryptocurrency market. And it’s very important to understand that these big banks that were the naysayers of cryptocurrency… they’ve now done a 180.

“It just shows that this isn’t going anywhere. This is here to stay. It’s the future of money.”

Jonathan is right. Crypto is still in its early days—just like the internet was in the ’90s. And smart money isn’t waiting.

Don’t miss your chance to get in early.

Talk to a trusted crypto expert at DailyPulseCrypto.com and take your first step today.